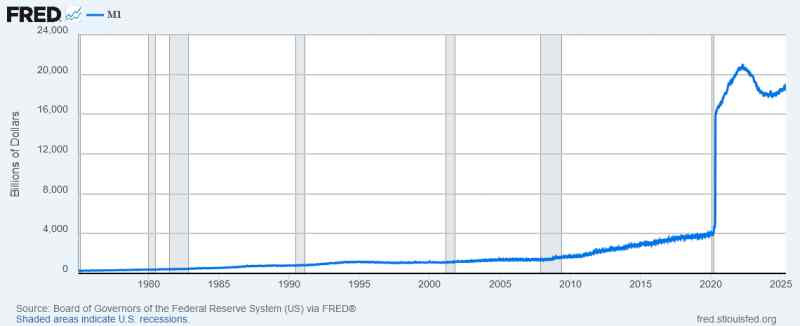

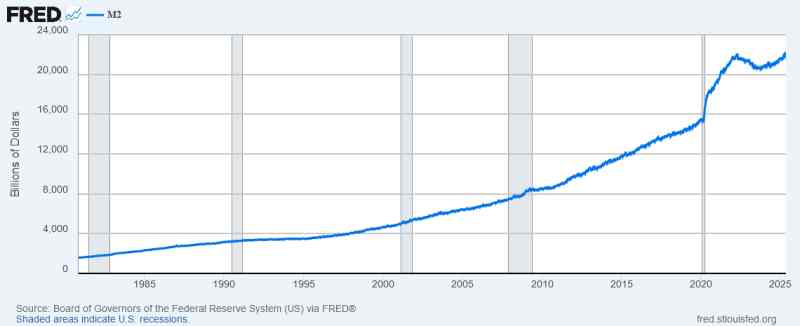

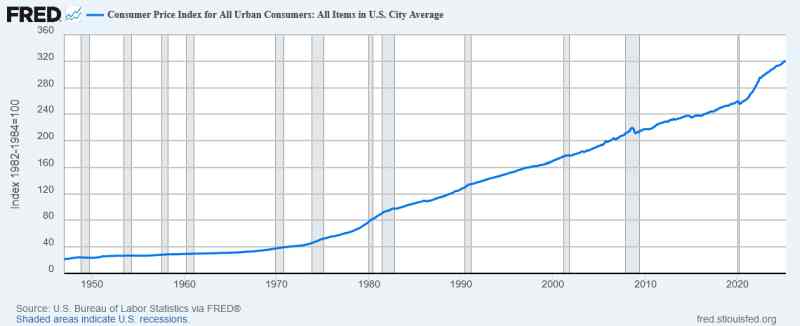

The world has seen a large increase in money supply in response to the financial crisis of 2008 and the Covid pandemic. Charts from the Federal Reserve Economic Data show a sharp increase in M1 money supply driving a steady rise in M2 money supply. This is causing an increasing CPI.

What is worrying is that the money supply seems to take a long time to increase prices of goods and services. We may see years of very high inflation.

High inflation is devastating and a good strategy is needed to survive the destruction of wealth. I have traveled in a number of countries as they were experiencing hyperinflation, namely Argentina, Venezuela, Indonesia and Zimbabwe. While everyone was badly affected some sectors fared less badly than others.

The sectors that still had some money were

- Government workers (they were poor but at least they had food and housing)

- Security firms

- Accountants

- Unofficial banks and money exchange

- Mining Companies

- Grocery Stores

- Luxury Hotels for International Travellers

- Criminals (smuggling, prostitution, graft and robbery)

- Private Doctors and Dentists

- Large Agricultural Businesses (though these were often targeted by the Government)

- Manufacturers for Export

Most of these businesses merely survived. Those businesses exposed to the international market thrived, this included Mining Companies and Export Manufacturers. Agricultural companies could have been very profitable in this environment except that the governments saw them as easy sources of revenue.

In western countries therefore a good strategy to offset the rising inflation will be to buy shares in mining companies.

Manufacturing businesses are profitable in countries with high inflation but not in the early stages. One good strategy may be to buy and store the required machinery before the exchange rate drops, then commencing manufacturing and export a few years into the crisis. Alternatively the money to buy the machinery could be set aside in a stable foreign currency.

In communist and former communist countries such as Cuba, Venezuela, China, Vietnam, USSR and North Korea there was no strategy to avoid the collapse. The only people left with any money in these countries were those with investments outside the country.

In all countries with high inflation the citizens conserved what money they had by buying foreign exchange on the black market. In Argentina the wealthy kept their foreign exchange in secret banks. When they had enough they would use it to buy property. Property increased as inflation did.

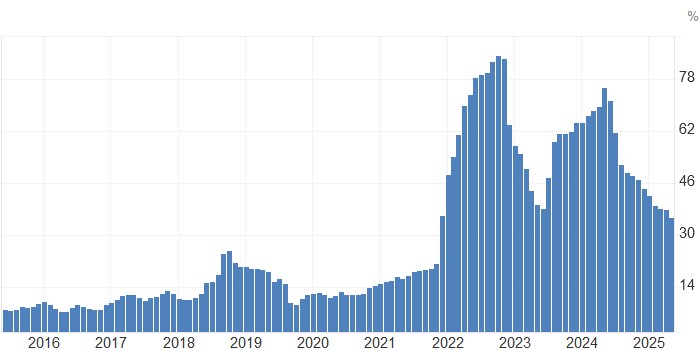

The stock market also maintained the value of the currency. The charts below (from tradingeconomics.com) show the rise in the Turkish Stock Market as inflation increased.

It goes without saying that gold and silver would also be a good store of value during times of inflation.